Australia’s payments system is entering a period of unprecedented transformation. Momentum is accelerating for the movement of payments to the innovative and data-rich New Payments Platform (NPP). This follows AusPayNet’s announcement of 2030 as the target date for decommissioning Australia’s legacy payment’s infrastructure, the Bulk Electronic Clearing System (BECS), along with Treasury’s plans to wind down the cheques system in the same timeframe.

Australian Payments Plus (AP+) is actively working with NPP Participants to drive this shift. We're excited to share an update on our work in supporting Australia as it prepares for this move and gets ready to realise the benefits of the NPP.

The importance of modernising Australian payments cannot be underestimated

The move to the NPP is a once-in-a-generation transformational opportunity to improve payment processes developed over 30 years ago and to modernise the business processes that have been built on top of these batch-based, Monday to Friday payment systems. BECS has been reliable and low-cost, but the needs of Australian businesses and consumers have changed.

Everyone from governments, to corporations, to small businesses and consumers now need the benefits of always available, faster payments that are data rich to thrive in the digital economy.

As a legacy system, BECS is difficult to improve or alter. Its messaging format shares limited data, preventing automating the reconciliation of payments and making it harder to screen for financial crimes. BECS does not meet the needs of Australia’s digital economy into the future.

Businesses of all kinds will benefit from greater efficiency and productivity in payments processes, improved fraud and audit controls, richer data, and automated straight-through processing and reconciliation. In the global digital economy, these are must-haves for Australia’s competitiveness. The NPP was designed to meet these needs and also to adapt and grow in the future.

Another important aspect of the NPP is the capability to support reduced scams and misdirected payments. In addition to the role PayID already plays in directing payments easily, Confirmation of Payee (available in 2025) will provide a layer of protection for payments to a BSB and account number by matching the account details entered with the account details held by the recipient’s bank and displaying a match outcome.

Moving to a more modern, future-ready payment system will improve day-to-day experiences for government, business and consumers, ultimately benefiting everyone in Australia.

NPP transaction volume continues to grow

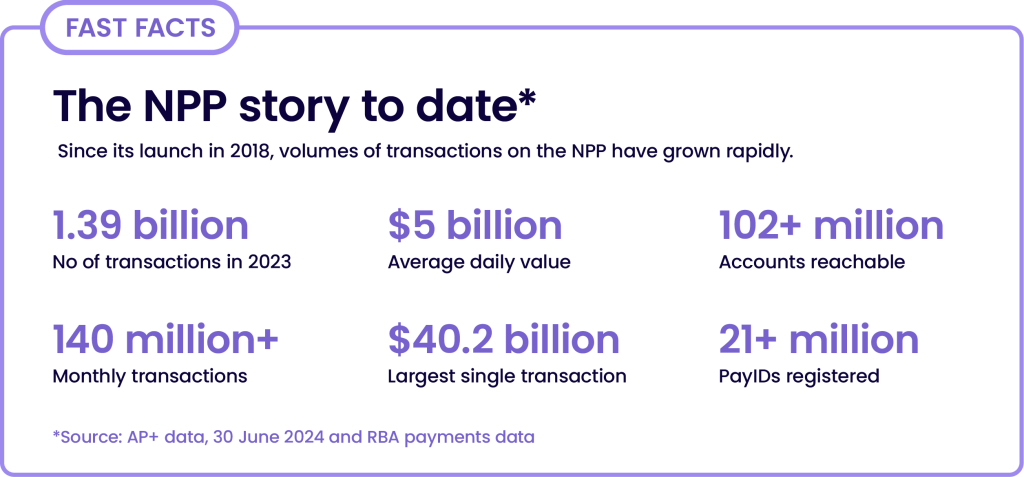

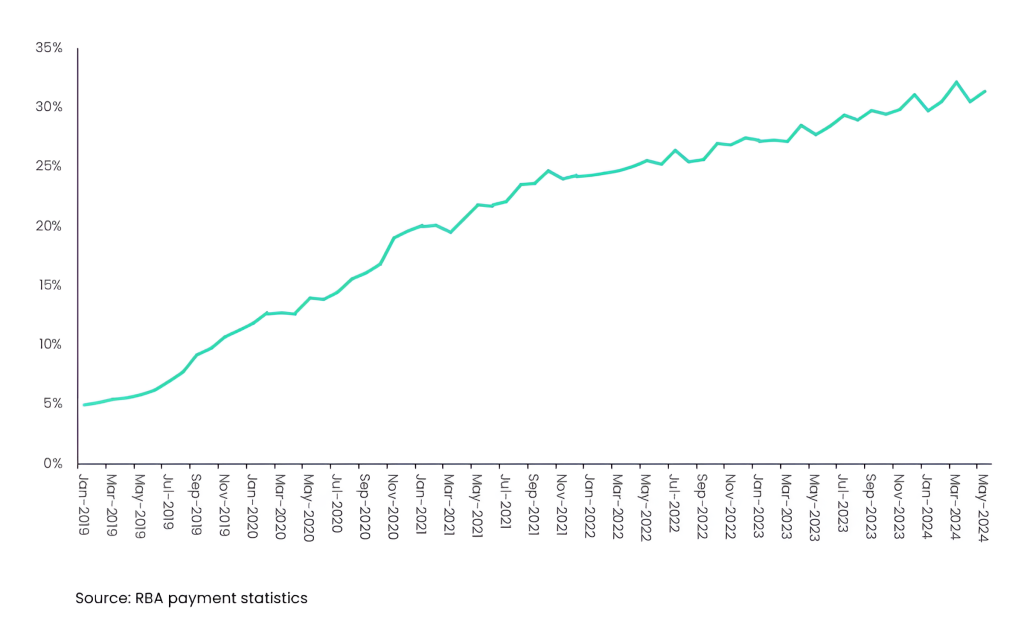

Since its launch in 2018, the NPP has increasingly served its role as Australia’s fast-payments infrastructure, with 1.39 billion transactions processed in 2023 alone and with an average daily payment value of more than $5 billion. NPP payment volume grew by 20% in 2023 and continue to grow 20%+ each month compared to last year.

Today, more than one-third of account-to-account payments are processed using the NPP. Yet, while payment volumes on the NPP continue to increase, there is a significant amount of work ahead for AP+ and the industry to meet the 2030 target date for decommissioning BECS. The work spans across AP+, financial institutions and the broader payments ecosystem. It will be a multi-year journey.

Our programme of work is accelerating

AP+ has nearly 40 team members dedicated to the movement of payments to the NPP, with a comprehensive programme of work underway to support the industry make this shift.

The programme aims to support NPP Participants and other financial institutions in moving the remainder of direct-entry payments to the NPP, as well as supporting the broader ecosystem in terms of education, readiness and change management.

Some of the AP+ current focus areas include:

Supporting the transition of payment files submitted in bulk. The NPP is designed to facilitate single payment instructions rather than bulk files to enable real time payments and to allow for the isolation of payment issues.

In migrating bulk payments to the NPP, businesses can work with their financial institution on ‘debulking’ their payment files or they can use alternative methods such as submitting payments via APIs. We’re seeing a combination of both approaches to migration.

AP+ has received industry feedback that a standard process for managing large bulk files would help facilitate migration. We are currently working on this approach in consultation with the industry.

Enabling sufficient capacity to process BECS payment volumes. The NPP already has the capacity to support more than double current payment volumes. AP+ will continue to implement capacity uplifts well ahead of the scheduled BECS retirement date and work closely with current NPP payment scheme Participants on their plans to increase payment capacity.

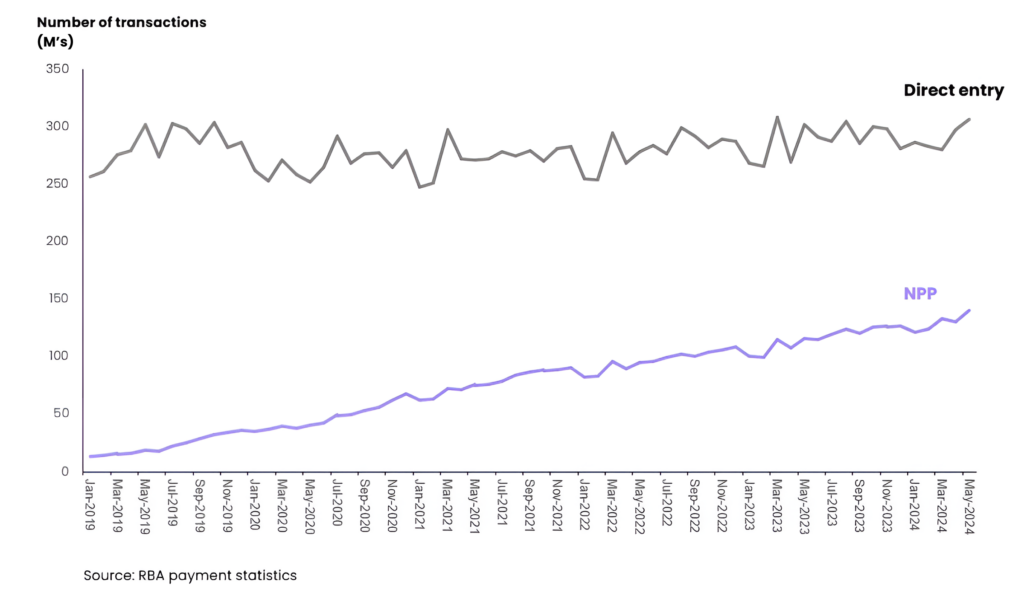

Direct entry and NPP payment volumes

NPP share of account-to-account transactions

Supporting users to assess NPP costs and value. The costs of operating the NPP are largely fixed. As the volume of payments processed by the NPP continues to grow, the per-transaction cost will continue to decline. The implied average wholesale transaction cost at the scheme level has decreased from $0.39 in 2019 to $0.04 in FY25.

NPP transaction costs cannot be assessed in isolation. It’s important to recognise the less visible efficiency savings that the NPP delivers such as major reductions in manual reconciliation and reduction in failed or mistaken payments.

Uplifting the technical infrastructure capability of the NPP platform. Alongside the payments migration work, AP+ is driving two parallel projects to uplift the technical infrastructure capability of the NPP platform.

One of these projects is an upgrade to the most recent ISO 20022 payments messaging standards. ISO 20022 will be the common language of the global financial industry, introducing many new data fields for the transmission of payments, strengthening operational resilience in payments and enhancing straight-through processing.

The second project, SWIFT cloud enablement, will facilitate Participants moving their own infrastructure to cloud environments to take advantage of reduced costs and more efficient use of technology.

In addition to these areas of focus, AP+ is working closely with current payment scheme Participants on their NPP priorities including:

Connecting accounts that currently send and receive payments via BECS to the NPP. At present, the NPP reaches 90 per cent of all BECS reachable accounts. NPP Participants have plans in place to connect nearly all the remaining accounts well before the retirement of BECS.

AP+ will continue to work with Participants and the broader industry to resolve any remaining reach gaps well ahead of the BECS decommission timeframe.

Working with financial institutions to drive improvements to reliability of their NPP services. The central NPP infrastructure is distributed architecture with multiple production and back-up sites. Since its launch in 2018, it has been highly resilient with zero failures of the central NPP infrastructure.

Participants continue to build resilience and capacity in their NPP processing and systems. In recent years progress in these strategic deployments have unfortunately seen planned and unplanned outages for individual Participants. These outages continue to be reduced whilst recovery times have improved and impacts to payments minimised. To compare, these Participant outages have been significantly shorter in duration than the time between transaction processing windows on the legacy BECS infrastructure.

All NPP Participants must meet stringent availability requirements of no more than two minutes outage per month. The consequences for failure to meet these requirements include non-compliance charges which range into millions of dollar penalties. AP+ will continue to work with NPP Participants to drive improvements in resilience.

Unlocking the potential of modern payments

Australia can look forward to a payments system where:

- payments get made in real time every hour of everyday,

- employees receive their salaries as soon as they’re paid,

- emergency assistance payments in times of crisis can reach people’s accounts in seconds, and

- organisations can save time and money with more efficient payment workflows.

These are just some of benefits that the NPP delivers through real time data rich payments.

As we move forward with the move to the NPP, AP+ will continue to collaborate closely with the industry to navigate the opportunities and challenges that lie ahead in reshaping Australia’s future of payments.

For more information on our programme of work, please contact info@auspayplus.com.au